The Evolution of Greed and Employment Contracts

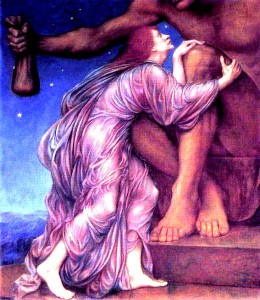

THE WORSHIP OF MAMMON by Evelyn De Morgan/Image: Wikipedia

“Dishonesty is not so ancient as greed, for hunger is older than property.”—Will Durant, Vol. I,The Story of Civilization

“Be Fearful When Others Are Greedy and Greedy When Others Are Fearful”—Warren Buffett

Uncontrolled greed is very much in the news these days, cited as a cause—perhaps the prime cause—of the 2008 financial tsunami, of the looming and virtual bankruptcies of American cities, of the collapse of the Greek economy, of rampant obesity, of absurd muggings to get a pair of Nike shoes, of convenience store raids by flash mobs, of canceled city services, of burgeoning and unsupportable pension liabilities, of obscene Wall Street bonuses, of….get the drift?

Yet, when a recruiter is sandwiched between the desires of the hiring company and those of the job candidate, greed is—or is expected to be—discreetly and conspicuously absent from both thought and speech, indeed, seemingly banished, as an unseemly and irrelevant variable. And it is. Can you recall the last time the “G” word entered into your job placement discussions, with either or both sides of the hiring supply-and-demand equation?

No, your negotiations and representations are virtually certain to be genteel, gentlemanly—no publicly hurled accusations of high-off-the-hog hoggishness or outrageous avarice. No soap-box venom or mike-snatching ranting against management that is too greedy for profits or employees too greedy for benefits. By comparison, your job is more like an eternal Woodstock love-in than a stock market orgy of greed.

So, why is greed making such big headlines in the world at large, but nary a mention in your daily recruiting, despite the same incentives and temptations on all sides, including yours, to consider being greedy, if only this once, this time?

Is there something that you and the two other parties to your deals cerebrally, viscerally or otherwise instinctively know about “greed management” that the rest of the world doesn’t even dimly grasp? Judging from the news and complaints about ubiquitous and diverse forms of greed, it seems that, indeed, that, for the mass of humanity outside your office and negotiations, rampant, unchecked greed is a way of and weight on life.

Even before the 2008 meltdown, in his July 19, 2007 Time Magazine article, Michael Kinsley, now writing for Bloomberg News, seemed prescient: “Ordinarily, the concept of greed isn’t very useful in trying to understand the economy. We are all greedy. We’d all like more. The magic of capitalism turns our individual greed into general prosperity. But maybe an especially virulent strain of greed is spreading, something like bird flu. Maybe this is a greed so profound that it blinds its victims to their obvious self-interest. Maybe this greed can turn the brightest men into fools. It’s hard to think of any other explanation.”

Now segue to the current “Occupy Wall Street” protests against corporate greed and Michael Moore rallying anti-corporate sentiment through this very recent expression of his long-held view that “we as Americans have allowed a very small group of people to be highly skilled practitioners of one of the seven deadly sins, and that sin, of course, is greed.”

For balance and completeness, of course one must note the latest reports, blog postings and stories decrying greedy lawyers, labor union bosses, labor union rank-and-file members, baby boomers, teenagers, commodities speculators, school teachers, derivatives addicts, and all others to be found and accused among the 54.9 million Google returns under the keyword “greedy” search (as opposed to the mere 516,000 returns for “abstemious”—the presumptive antonym of “greedy”).

Before speculating on why you and your clients can somehow manage the miracle of controlling and inhibiting greed when others cannot, it’s important to understand more clearly why it exists and what its probable future is likely to be. As for its past, the origins of greed lie in nothing recent: The brilliant Will Durant, in Volume I of what is arguably the most engaging and readable compendium of the history of Western Civilization (which he and his wife compiled over decades), noted just how ancient greed is—“The animal gorges himself because he does not know when he may find food again; this uncertainty is the origin of greed.”

Famine-Panic

Focusing on the present and the future, as long as the current jobs, housing, confidence and debt crises continues, if not worsens, the average casualty of any of these stressors is likely to become or seem to become more greedy, since many of these victims are in a psychological state comparable to the kind of famine-driven panic that manifests itself as hoarding and scrambling for whatever is available and for more. This forecast follows from the premises of evolutionary logic and theory that identifies past famine as a—if not the—key variable of natural selection that rewarded the greedy with longer lives and more surviving offspring.

Even those who currently have nothing immediate to fear, e.g., because of solid savings and investments or good, safe jobs, may display symptoms easily interpreted as greed, such as stockpiling food and other supplies for emergencies like the Mayan Apocalypse; negotiating and accepting unreasonably high public sector pensions, in part from fear of having less should the dollar collapse; expecting and getting stratospheric Wall Street bonuses while the getting is good, while getting away with it is possible and before getting out of town becomes necessary to escape the torches, tar and pitchforks of outraged protestors and Hooverian armies of the homeless.

The Ungreedy Recruiting Industry

The immediately foregoing provides a central clue as to why you, as a recruiter mediating between client and applicant, as well as the latter two groups themselves, are perhaps more successful at greed management: All of you in the recruiting triad are in a situation characterized by hopefulness—the reasonable hope that a job placement is imminent, that both the candidate and the company are “serious”, that the job will be satisfying and satisfactorily filled, that the salary and benefits will be sufficient to prevent “famine panic” and that, above all, you as the mediator between the candidate and the company will have a vested interest in doing your best to make sure that greed on either side of the deal won’t queer it. You are not, in general, in the grip of famine-panic.

You, recruiter, do not have to deal with those in famine-panic mode, because you are unlikely to be interviewing them. That’s because the kinds of credentialed candidates who have made it as far as an interview with you have far more reason to be hopeful than those applying farther down the job-and-food chain and those whose resumes are shredded upon receipt—especially those rejected precisely because they are in the famine-panic state of mind prolonged unemployment will trigger.

You will not be dealing with minimum-wage workers who are unable to find even that kind of minimal employment and who, to minimum-wage employers, seem greedy for hoping for more, in the form of more per hour, rather than more hours per day. Nor will you be dealing with the “get-rich-quick” mentality of real estate, commodity and equities speculators or casino gamblers.

This latter consideration is important: When making money or generating other kinds of wealth is easy, it can equally easily become addictive—especially when recent successes fuel feelings of invincibility or casino-esque luckiness. You and virtually everyone you deal with know that there is work to be done—lots of it—to earn the hoped-for rewards. No easy roll of lucky dice blown upon by a shapely tableside lucky charmer.

Moreover—and importantly, you are for the most part not dealing with “rigged games”, e.g., no-bid contracts that allow for inflated, greedy pricing; candidates with a monopoly on a given skill set that might tempt them to ask for the moon; companies without competitors; jobs and companies without audit trails. In short, recruiters and recruiting don’t make it easy for those who would dare be greedy.

Feasting-Frenzy

Just as evolutionary theory and logic help explain the origin of greed, they help account for its persistence, by means of the evolutionary and historical diametrical opposite of the famine panic: the situation in which a mad scramble for more resource is triggered not by famine, but by feast, like those served up in the past sub-prime mortgage and ongoing, unregulated derivatives-market banquets.

Here’s a prime and primal example of such “feast-frenzy”, a surplus-driven, rather than shortage-motivated variant of shark and piranha feeding frenzies in the midst of a prey bonanza: When a male is extraordinarily successful with many women, he will often inexplicably want more—insatiably more. We all know at least one such lothario. I know several—who are very and uncountably (and, given their flaws, unaccountably) “successful” at this. Why such greed? Because the unconscious logic of the “selfish gene” dictates that such a player make as many copies of his genes as possible through as many liaisons as possible, if 1. he can do it; 3. he can afford it; 3. he can get away with it.

From his genes’ “perspective”, other guys simply don’t have the appeal and opportunities he does, and choose the path of fewer potential offspring. While he thinks he’s having fun, his genes “think” they are making babies. Ditto for material as opposed to genetic treasure: So long as amassing and generating wealth and other resources is easy, it is very likely to become for some, maybe many, certainly not all, addictive. Like ever-available colas and French fries.

To get the flavor of this kind of insatiability, greed-oriented reasoning, this quote from Washington State University associate clinical professor Richard Taflinger, should suffice:

“Any form of life must gather resources that allow it to survive and reproduce. The resources may be food, water, sunlight, minerals, vitamins, shelter. Without these things, the organism dies. Since the two most basic purposes of life are to live and to reproduce, it should do everything it can to avoid dying through a lack of resources.

Greed is one organism getting a larger piece of the pie, more of the necessary resources, than other organisms. For example, in the Amazonian rain forest, an occasional tree dies and falls. This leaves an opening to the sun in the continuous canopy of foliage. Plants and trees race each other to grow into that opening. The winners in the race fill the hole; the losers die through lack of sunlight. (Attenborough, 1990) The greed for sunlight means life.

Again, as for self-preservation and sex, greed is an instinctive reaction. When presented with resources, the instinct is to grab them, use them, take advantage of them. This isn’t a conscious decision. An animal, when starving, wants more food; when thirsty, more water. If it means taking it from another animal, that’s what it does if it can.”

Neurology Never Lies

If such sociobiological selfish-gene reasoning about easy feeding-frenzies is unconvincing or otherwise repellent, just drop into any fast-food franchise and watch the super-sized customers piling on the super-sized meals, or, get acquainted with some basic neurology of pleasure, as reported by Stanford psychology professor Brian Knutson, whose “neuro-economic” research has identified a neurological link between financial risk-taking for big gains and sexual greed, at least in men.

The 2008 study, completed before the financial holocaust that year, focused on the sex-and-money center, the V-shaped nucleus accumbens, which sits near the base of the brain and plays a central role in what is experienced as pleasure. What the study found was that when this region of the male brain was “lit up” during scans by viewed pornographic images of women, the young men made bigger bets in simultaneous experimentally controlled gambling situations. An earlier study by the same team found that the brain’s reward area lit up at about the same time as risky decision-making.

In simplest terms: “You have a need in an evolutionary sense for both money and women. They trigger the same brain area,” said Camelia Kuhnen, a Northwestern University finance professor who participated in the study. I’m calling this the “Mammon-Momma Nexus”: More money means more hot mommas and risk-taking to get more of both.

As for the influence of the casino charmstress, this was what Knutson had to say about that: “ “It didn’t matter if the sexy woman didn’t tell you anything about the odds of winning a roulette game. What really matters is that the sexy woman is having an emotional impact. That bleeds over into your financial decisions.”

Now, the relative absence of greed in recruiting should be easily understood: Because you, recruiter and your clients, in negotiating employment contracts , are operating somewhere between the extremes of hard famine and easy feast, and enjoy other pleasures besides the satisfaction of getting more and more of everything and of yet another woman (or man), there is neither the need nor the incentive to be greedy.

At least, not for now.