Financial Services Companies: Here’s Where to Find the Talent You Need

New site selection research from my firm, The Boyd Company, Inc., has identified the top 20 cities for the financial services industry when it comes to expanding and hiring.

Key qualifying factors in the survey include the availability of skill sets in banking and financial services, the ability to locally recruit graduating finance majors, comparative office operating costs, and a new driver in our city searches: accessing talent in artificial intelligence (AI).

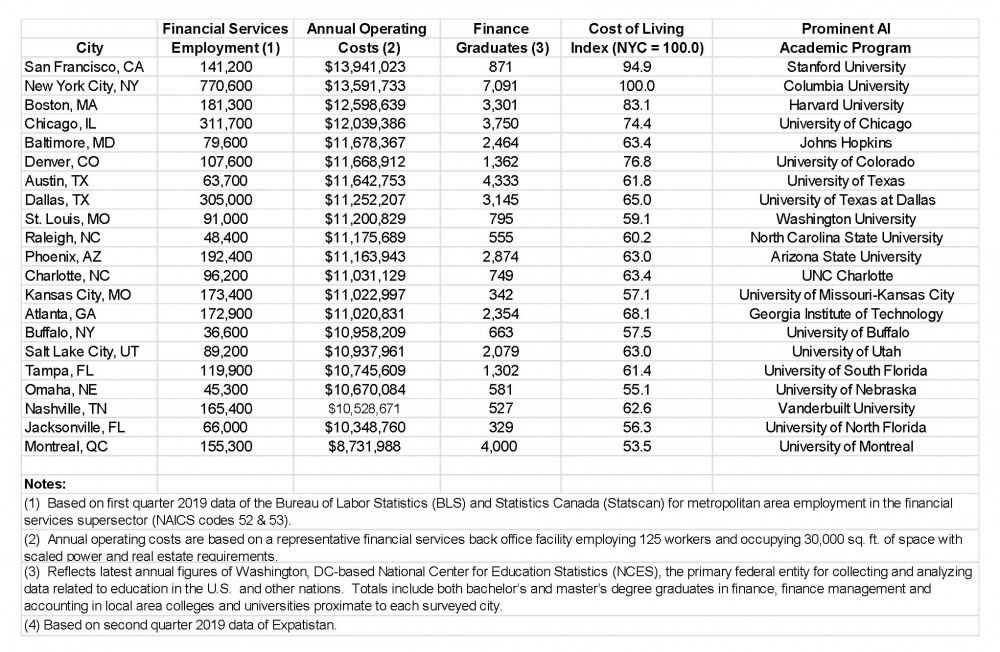

The 20 cities — 19 in the US and one in Canada — are detailed in the chart below in the order of annual office operating costs, from the highest in San Francisco to the lowest in Montreal. Site-seeking banks and financial services companies would do well to take note of these cities. They represent the best opportunities for recruiting the skilled workforces financial operations need:

Finance Skills Are in Great Demand

Financial services firms are facing one of the tightest labor markets in history. Unemployment rates are at record lows across industries, but they are particularly low in financial services: In July 2019, the US financial services industry saw an unemployment rate of 1.5 percent, compared to 3.7 percent across all industries.

Compounding the recruiting challenges brought on by the low unemployment rate are new hiring pressures exerted by tech employers in the growing financial technology and eCommerce sectors, which are now recruiting heavily within the financial services space. Interest in candidates with finance degrees has never been this strong: According to the “Job Outlook 2018” survey from the National Association of Colleges and Employers, finance is the most in-demand degree sought after by corporate recruiters.

In terms of a city’s ability to provide an ongoing supply of qualified candidates and offer sound continuing education resources for financial services professionals, leading cities include New York City (7,091 annual finance graduates), Austin (4,333 grads), and Montreal (4,000 grads).

Organizations Are on the Hunt for AI Skill Sets

AI is disrupting many industries, including the banking and financial services sector. As this new technology unearths great opportunities for improved efficiencies, it is also creating new talent challenges. One of these new challenges is determining the best place to relocate or expand offices and service centers of banks, insurance companies, investment houses, and other financial services companies that are increasingly relying on AI. As more and more financial services companies find themselves in need of the latest AI skill sets, they’ll need to focus heavily on those North American cities housing superior academic programs in AI.

For more expert recruiting advice, check out the latest issue of Recruiter.com Magazine:

As new technologies like AI take hold, there are concerns that many jobs in banking and financial services will be lost. JPMorgan Chase is programming thousands of databases to accommodate machine learning and is already using AI to compose advertising copy for its credit cards and mortgages. Citi president Jamie Forese predicts AI could mean the loss of 10,000 jobs at the bank over the next five years. Especially at-risk roles include customer service reps, financial managers, compliance agents, and loan officers.

But Forese’s projection fails to tell the whole story. While AI will indeed displace jobs in some areas, it will also create a significant number of new jobs elsewhere in financial organizations. The job losses will mostly occur within the transactional workforce, while the job gains will be in higher skilled AI-related positions like risk analysts, actuaries, financial analysts, investment bankers, foreign exchange traders, and fraud prevention specialists. What financial services firms should focus on most today is building pipelines for automation talent, and that requires determining where this talent can be found.

The top ranked city for AI talent overall, according to our study, is Montreal, which houses one of the world’s top labs for deep-learning research: The Montreal Institute for Learning Algorithms (MILA). Montreal also benefits from its deep pool of financial services workers, Canada’s recruiting-friendly immigration policies, and the country’s favorable exchange rate. Montreal has already attracted jobs from Boston-based State Street and New York City-based Morgan Stanley, along with major AI players DeepMind, Facebook, Google, Microsoft, Samsung, and Thales.

The top ranked US city for AI talent, Salt Lake City, houses growing financial service centers of Goldman Sachs, Zions Bank, Discover Financial Services, Wells Fargo, JPMorgan Chase, and Fidelity. The University of Utah’s School of Computing has one of the top AI programs in the West. Utah is also home to 15 chartered industrial banks, one of the highest concentrations in the entire country.

Recruiting Top Talent While Keeping Costs Down

Operating cost factors — including salaries for office support staff, real estate, utilities, taxes, and other occupancy costs — were also factored into the survey. In response to rising regulatory and compliance expenses and competitive pressures on a global scale, banking and financial services organizations are increasingly turning their attention to the cost side of the ledger. Cities showing attractive operating cost profiles alongside their recruiting strengths include Montreal ($8,731,988 annual operating cost on average); Jacksonville, Florida ($10,348,760 annual operating cost); and Nashville ($10,528,671 annual operating cost).

John Boyd, Jr., is principal at The Boyd Company, Inc.