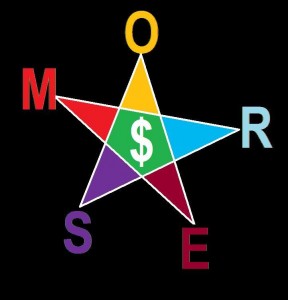

M.O.R.E.S.: The Five Costs of Recruiting

M.O.R.E.S. COSTS/Image: Michael Moffa

Cost-free recruiting— wouldn’t it be nice? Well, no, since you wouldn’t have a salary or get commissions. Besides, there would still be the well-known and well-analyzed “opportunity costs” associated with making your picks and choosing candidate X over Y. Those cannot be eliminated, unless you are forced to hire the last person on Earth, which would also force a shift in the wording of a negative review from “I wouldn’t hire him if he were the last person on Earth” to “I’m hiring him because he is the last person on Earth.” Then there would be no associated opportunity cost, assuming you couldn’t take the job yourself.

Apocalyptic Omega-Man scenarios like that one aside, most recruiting situations will also include four other costs that, along with opportunity cost, although not usually explicitly mentioned as often as the latter, do factor into and (should) influence the hiring choices you make. Call these the “Big Five”—the “M.O.R.E.S.” costs.

Getting M.O.R.E.S. Bang for Your Recruitment Buck

“M.O.R.E.S.”—my coinage—represents five real, distinctive costs of recruitment : Maintenance, Opportunity, Replacement, Evaluation and Search costs. Interestingly, not only are these operating costs, but they are also forms of service, unlike the indirect service cost of your workplace lunch, toner for your printer and the cost of your professional haircut. What makes M.O.R.E.S. distinctive is that they translate into costs that double as core services. Here’s how.

Unlike the cost of paper clips or your suit, which facilitate, without being, a service, evaluation of and search for candidates are services as well as forms of costs, viz., evaluation costs and search costs. Likewise, if a given candidate has to be replaced for reasons that do not discredit your choice, e.g., illness, your company or client can reasonably hope that you will find a replacement. Moreover, to the extent that you offer follow-up “maintenance” service, in the form of post-placement “check-ups” on hiree performance, recommendations of additional staff required to balance the recent hire’s skill set, general goodwill calls to confirm your aftercare service, the costs—in time, energy or other resources—are also measures of that core service.

M.O.R.E.S. as Future vs. Past Costs

As costs, M.O.R.E.S. have a prospective as well as retrospective side: You can estimate these costs after a hiring, or before. It’s the pre-hire estimate that gets interesting: Suppose, for example, that you know that if you hire candidate X instead of Y, the replacement cost, were it to become necessary to find a replacement, would be substantially higher. How can that be? One of two people is chosen for the same job, so how can it be more expensive to replace one rather than the other? Here’s how: Imagine the candidate hired was strongly recommended and backed by your supervisor, but that her performance has not been up to snuff. Now you have to break the news to your boss, as the evidence mounts that a replacement is needed. That makes the replacement cost (and risk) to you much higher than it would be if you were to hire the other unchampioned candidate.

Or consider this scenario: A new regional office of an international newspaper has to hire a start-up editor-in-chief and lower-level editors, and has narrowed the list down to two kinds of candidates. The first is British, the second American. The variant of English selected will determine the format, in perpetuity, for the magazine—British vs. American English. (Note: This is not hypothetical. That’s exactly what happened years earlier during the start-up at one of the world’s most well-known international newspapers for whom I worked.) Assuming all other things being equal and factoring in replacement costs, which group should be hired—staff from the U.K. or the U.S.A?

A farsighted manager would consider the foreseeable as well as current supply of both, e.g., will consider which, down the road, will be easier to recruit in Tokyo, Chicago, Hong Kong or London (the London choice being a no-brainer, from the British perspective). If this is not clear, consider the choice CNN made in replacing the raw Brooklynese of Larry King with the posh patricianese of Piers Morgan. Clearly the search and replacement costs entailed by attempting to replace Larry with Larry 2.0 would have been prohibitive if limited to the category “from Brooklyn but nonetheless admired by aristocrats, diplomats and Californians”.

Interdependent yet Distinct Costs

One interesting insight to be gleaned from this example is that the five M.O.R.E.S. costs, although distinct from each other conceptually, are not always in practice independent of each other, as evidenced in the fact that search and evaluation costs can be lumped under replacement costs when there is no pre-qualified candidate available as a replacement. That’s a feature that could lead to some very creative accounting, if all such costs were cash costs only.

As for opportunity cost as a service, even though, unlike maintenance, replacement, search and evaluation, it is not customarily or readily thought of as being such, it is a service to your company or client, to the extent that you are obliged, under the terms of good service, to do your best to minimize it.

The Case of Future S&E Costs

To return to the distinction between pre- and post-hiring estimation of costs, it is rather unlikely that you routinely estimate maintenance, opportunity, replacement, evaluation and search costs prior to the start of your recruitment process, indeed, if you ever consider them at all. Have you ever asked yourself, “I wonder what the opportunity cost of short-listing X will be?”—prior to hiring? Or, “What will be the likely replacement cost associated with hiring X instead of Y?” Probably not, since it is tempting to assume that it is the job that has to be refilled, not the person—freighted with the peculiarities of his or her connections, language, etc.—who has to be replaced.

The same goes for S&E—search and evaluation: Consider the S&E cost difference between trying to prove there are skeletons in the closet of a rival party’s suspected cross-dressing presidential candidate and trying to prove, when challenged, that there are none, for your party’s family-values, saintly presidential contender. With a limited budget, which S&E task makes more sense purely in terms of saving more dollars?

The Costs of Ghost and Unicorn Hunting

Logic lesson: Trying to prove something doesn’t exist will always be more expensive than trying to prove it does. Try to prove there are no ghosts or unicorns; now try to prove there are. Which task will take longer, if not forever? So the attempt to prove there is no “dirt” will cost more, in virtue of the fact that it is a potentially endless search, whereas as soon as a speck of political dirt turns up the search is over. In logical shorthand: “You can never conclusively prove something doesn’t exist (unless it’s a self-contradictory concept, like “four-sided triangle” or “completely honest politician”—OK. Kidding about the politician).

False Positive vs. False Negative S&E Tests

A further lesson to be extracted from this one is that in your S&E costs-stage of recruitment, you should be aware that trying to prove that a candidate can’t perform will often be harder and costlier than proving that he can. Sure, you can utilize a personnel test with a kind of pass-fail score or cutoff point. But, which is likely to be more conclusive: a high score, or a low one? Which is more readily influenced by unidentified performance variables, such as a bad headache, jitters or insomnia—an over-achievement or an under-achievement? To rule out factors that may have contributed to a low score is likely to require more time, talk, observations and energy than ruling out factors that may have inflated the score (apart from any possible cheating).

Considering the differences between these costs is akin to comparing the differences in the cash, social and psychological costs of choosing a test with a high rate of false positives rather than one with a high rate of false negatives. As S&E tools, medical tests with different error risks represent different degrees of cost. Hence the greater S&E costs associated with trying to rule out a false negative result, viz., a low test score for an unrecognized talented applicant.

That’s AMORES, Eh?

As for maintenance costs, to estimate these as future costs, just imagine you are going to marry, rather than hire, a candidate. That’s effective because everybody can tell in advance whether a potential spouse is going to be high maintenance or not.

Just hand over your credit card or the TV remote–before the wedding.

If you don’t want to have to do it after.