5 Candidate Sourcing Metrics Every Recruiter Needs to Track

In the recent past, there has been a sea change in the way organizations source and recruit candidates in the labor market. In earlier times, organizations would source candidates as a reaction to job needs. Now, more employers are proactively working to predict future hiring needs, source ca n didates, and build talent pipelines so that they’re ready to hire as soon as a new job opens up.

Reaching out to the right set of candidates to fill a particular position is one of the biggest challenges faced by recruiters and hiring managers (I can see you nodding your head in affirmation!). When we are knee-deep in our work, sometimes it’s hard to see the big picture.

One solution to this problem is to devote a certain amount of time every week to reviewing your organization’s sourcing metrics and working on ways to improve them. Before we proceed on that note, you might want to take a look at the top candidate sourcing techniques for 2021 if you plan on getting a head start over your fellow recruiters.

That said, here are some of the key metrics related to sourcing candidates that you need to study on a regular basis if you hope to improve your sourcing efforts:

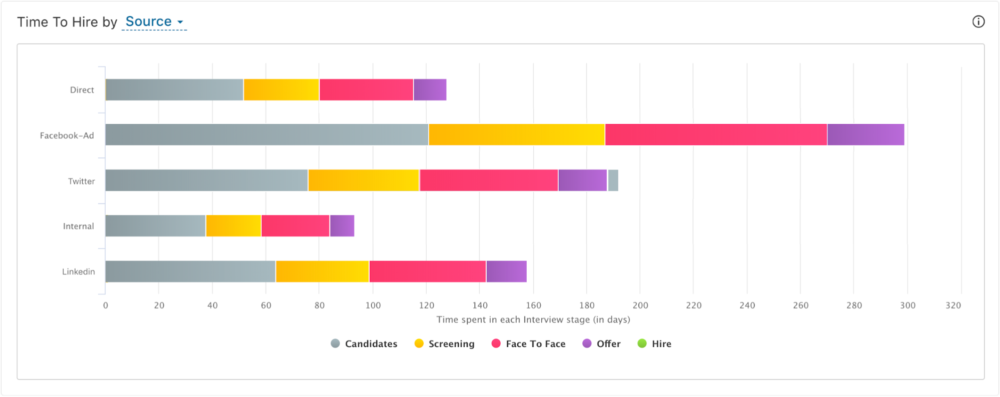

1. Time to Hire by Source

This metric tracks the amount of time it takes to hire a candidate from a given source, starting from the time the candidate was first identified.

By tracking this metric, you can:

- Allocate your resources to the most profitable channels.

- Find and unblock bottlenecks in the hiring pipeline.

- Tweak or do away with channels that take too long to hire.

Once you parse the data, you can narrow down the sources and/or job titles that seem to have longer times to hire.

Then, you can find out where the problem lies. Is it with scheduling interviews, screening, availability of the interviewers, or the candidate’s interest?

Next, work on addressing identified bottlenecks. For instance, if you see there is a delay in the hiring process due to inadequate interviewers, you can work on improving the interviewing panel’s skills.

Your issues might not always be internal. For example, if you observe that candidates sourced via Facebook take longer to respond to interview scheduling requests, it’s possible these candidates aren’t interested in pursuing your role. This could mean there might be an issue with the source itself, in terms of the kinds off candidates it attracts.

2. Cost per Hire by Source

This metric tracks the ratio of your total internal and external recruiting costs to the total number of hires from a given source in the same period.

Recruiter salaries, interview costs (number of hours times the hourly salary of the interviewer/hiring manager), employee referral bonuses, and fixed costs such as physical infrastructure make up your internal recruiting costs. On the other hand, advertising costs (such as job boards), agency fees, technology costs (such as recruiting software ), career fair and recruiting event costs, travel costs, facilities costs, relocation costs, and signing bonuses comprise the external recruiting costs.

The objective of this metric is not to cut costs. It is to figure out how, when, and where to allocate your budget in order to attract and hire great talent.

Some of the low-cost ways you can optimize this cost are:

- Be active on your sourcing platforms, like your career sites, job boards, or social media channels. Outdated information is going to drive away prospective candidates.

- Create great referral programs. This cost-effective channel will get you high-quality hires who are faster to hire, perform better, and stay longer at the organization.

- Leverage your organization’s general marketing efforts to get some publicity for your employer brand and hiring efforts.

- Invest in tech tools and software. Consider getting an applicant tracking system (ATS) that helps you streamline your process and, in effect, bring down your cost per hire by saving you money, time, and effort.

3. Effort per Conversion

This metric is estimated roughly by tallying up the number of conversations and interviews conducted before a candidate is hired. Invest in an ATS that has the ability to track all conversations with a candidate in one place, as this will make it easier to compare how much effort is spent on converting candidates from various sources.

The use of canned responses and templates can help minimize communication effort per conversation. Ensure all conversations with a particular candidate can be found in a single place so that anybody can resume the dialogue at any point in time.

Once you are sure your efforts in certain channels are not getting the desired output, then cut down spending on those channels or remove them altogether.

4. Funnel Throughput of the Candidate Pipeline

The conversion rate at each recruiting stage is known as the funnel throughput of the candidate pipeline. This metric helps shed light on the quality of your candidates, especially for roles for which you hire more often.

These data points will help you identify sources that have higher throughputs in the pipeline: sourced candidates, applicants, referred candidates, etc.

Direct your efforts to the sources that are giving you a healthy throughput. If job boards are working well for you, sift through the data and pin down the best-performing ones.

There are a few tips to help ensure you have a healthy throughput:

- High drop-off rates during the screening stages indicate that your job descriptions are misleading. Rework those so that all roles and responsibilities are clearly communicated.

- Make sure you are clearly communicating your expectations to the candidate sourcing team.

- Collect objective feedback from the interview panel in order to understand why candidates are rejected. This will help you refine future searches.

- Candidates might be rejecting your offers because they aren’t meeting talent’s expectations. The next metric covers this in more depth.

5. Reasons for Declining an Offer

When your top candidate rejects your offer, that means you need to restart your hunt — and nobody wants that. Tracking the reasons why candidates decline your offers will help you deal with the issue and avoid rejected offers going forward.

For instance, if “required to relocate” is a very common reason why candidates reject a particular job, then you might want to focus more on sourcing candidates who already live in the right geographical area. You could also create policies and incentives that make relocating more attractive to your prospects. Some organizations even hire agencies to help new employees relocate, going so far as finding their partners jobs in the same city and putting their kids into school.

It might seem time-consuming to pull data from so many different sources to create reports and track metrics, but investing in an HR reporting software can help you easily overcome this challenge. A good software will help create curated reports, give you the option to create custom reports and widgets, schedule export of reports, and keep them secure.

Hope you found this piece useful, but do bear in mind that these metrics need to be studied in tandem if you’d like to make the best candidate sourcing moves you’ve ever made! If you’re looking for a way to kick-start or totally overhaul your entire candidate sourcing strategy, we urge you to head to Freshteam. You’ll find that you will be able to find the right candidates from various sources, accept their applications, and manage them through the process. You’ll be able to enjoy the benefits of free job board integrations, customize your career site, automate actions, and do much more! Try Freshteam out for free here!

This article by Freshteam is built on the original article that first appeared on the Freshteam blog.

Recruiter.com regularly features reviews, articles, and press releases from leading businesses. This featured article may include paid promotion or affiliate links. Please make every effort to perform due diligence when selecting products and services for your business or investment needs and compare information from a variety of sources. Use this article for general and informational purposes only.