Higher Consumer Prices Fuel Inflation Fears

Over the last few years the U.S. Federal Reserve, in an attempt to stimulate the economy, has been buying billions of dollars in U.S. Treasury Bills, thus putting more money into circulation. The overall success of this policy is still open to debate. One aspect of the policy that has been consistently voiced by critics of Fed Chairman Ben Bernanke is that it may lead to inflation.

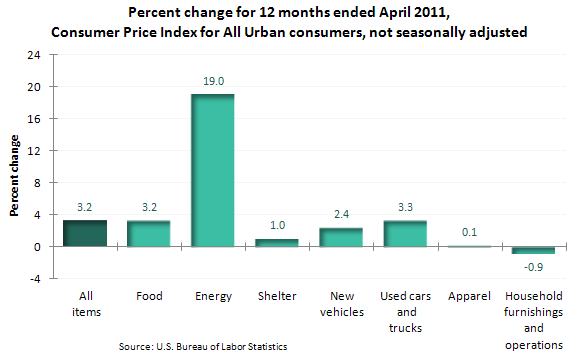

An increase in the Consumer Price Index for All Urban Consumers (CPI-U) of 3.2 percent in the twelve months from April, 2010 to April, 2011 could be seen as giving more credibility to those fears. This is the biggest increase in the CPI-U since October, 2008.

The Federal Reserve, however, tends to focus on the core CPI-U, which does not include volatile commodities like food and oil. The argument the Fed makes for looking at this stripped down index is that the changes in food and energy prices are expected to be “transitory” and thus the core CPI-U give a more accurate picture of inflation (as indicated in the minutes of the April Federal Reserve meeting). Considering that over the same one year period energy prices went up 19 percent, stripping these prices out of the index changes things dramatically. This core CPI-U is up only 1.3 percent over the year.

While the spike in energy prices might not be indicative of long term inflation, in the short term $4 a gallon gasoline isn’t doing much to speed up our economic recovery. Let’s hope the Fed is right when they say these spikes in commodity prices are “transitory.”